German mobile network operators Vodafone and Telefonica Deutschland are rapidly expanding their 5G network, deploying thousands of new antennas and other infrastructure systems to deliver the Industrie 4.0 data traffic and coverage needed by millions of customers.

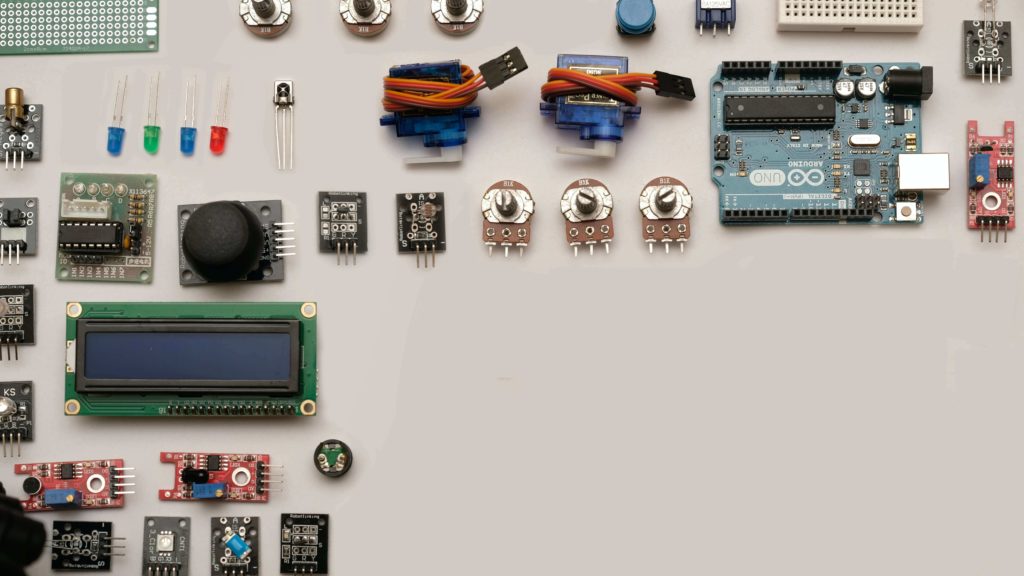

To process the massive amounts of data and information, the world needs powerful semiconductor components, controllers, memories and other electronic components in large quantities. Increasingly sophisticated automobiles with various driver assistance and/or comfort systems, virtual assistants, smart refrigerators and appliances are now part of everyday life and use a lot of different electronic components. In addition to e-mobility, the expansion of renewable energies is also driving up the demand for electronics.

Already in 2018 and 2019, there were bottlenecks in the supply of electronic components in some areas. The global pandemic additionally exacerbated the strained supply chains. According to experts, this problem will continue for some time and have an impact on all sectors of industry.

A confluence of problems

The main factors leading to the shortages are the increased demand starting with raw materials and the imbalance of supply and demand that has been building up for some time.

Years of falling prices in the area of active and passive components reduced investment and incentives to expand manufacturing capacity. Production of these components stagnated or grew only slightly over time. This led to shortages of electronic components in various places over the years, while supply chains were still intact at the time.

That began to change in late 2019 as telecom companies began rolling out 5G networks, new, more powerful, gaming consoles hit the market, and smart cars and devices multiplied. COVID-19 eventually caused serious disruption to electronic component supply chains, and we will continue to see fragile structures beyond 2021.

As the pandemic spread, production in various countries came to a partial standstill or was interrupted, as demand for components in some sectors was also sharply reduced. The health crisis forced some companies to halt production completely for weeks or months, while others scaled back production for fear of a slump in orders from their end customers. Another consequence was that production sites were also unable to obtain sufficient or timely supplies of materials or to make deliveries in full due to disrupted logistics.

Extreme weather events, trade wars, tariffs on imported Chinese goods – including many electronic components, contributed to the disruptions.

For example, automakers initially curtailed orders for semiconductors as COVID-19 cleared the roads of drivers. The small increase in production of active components that suppliers achieved in 2018 and 2019 was needed for other segments, particularly computers, gaming devices and Internet infrastructure, as their demand exploded as people began to work, teach and learn, play and socialize from home.

The pandemic also disrupted supply chains for passive components, as many raw materials became scarce and prices rose.

A networked world

As the boom in the electronics market continues, there simply aren’t enough capacitors, resistors and other parts to go around, which ultimately impacts all manufacturers and users of electronic devices and components, in other words, the entire supply chain.

5G technology is spreading rapidly, bringing with it a bevy of new 5G-enabled devices that require many more components than their 4G predecessors, along with more extensive infrastructures. Add to that the IoT movement, which is moving into more and more areas of our daily lives, from “smart” and connected devices like refrigerators to doorbell cameras to voice and APP-based controls, all of which require electronic chips and a range of other electronic components, as well as larger and more servers to process and store the exponentially growing amount of data. The result is already larger customer orders, with longer and more complex bills of materials. Many parts are becoming increasingly difficult to source.

For some parts that are not top priorities for manufacturers, there will likely be no funding for capacity expansion.

There is also a problem of transportation and regionality. The longer a supply chain is, the more interruptions and disruptions can occur. The pandemic was first detected in Asia. The lockdowns in that part of the world quickly reduced the production of electronic components but also of entire circuits, electronics and modules, many of which are produced in Asia and shipped to Europe, the U.S. and around the world for final assembly, affecting the entire global market, which needed these parts to keep its productions running.

Some countries are now considering moving production closer to home to minimize the risk of delays, disruptions, and potential cybersecurity risks, and to reduce transportation costs. Smaller supply chains are easier to control and adapt. They are less susceptible to uncertainties such as weather events, expensive air transportation, uncertain sea or land transportation routes, and a host of other issues that can throw the supply chain into disarray. Last but not least, while weeks of ocean transport are less expensive than air freight, once the goods are on the ship there is no way to intervene or expedite transport for several weeks. As the recent blockade of the Suez Canal demonstrated, the impact of a local disruption on the global market is significant.

The way forward

Amid shortages and crisis, the European Union is considering doubling its chip production to about 20% of global supply in the next decade. The plan will offer long-term solutions, but will do little to help the region’s industries today. Restoring, relocating or increasing production is not a simple undertaking, nor is it quick. It takes time, money and commitment from a variety of players who do not always pull together.

In the meantime, delivery times for components have not improved. Bottlenecks are expected to continue at least into next year. Procurement of components continues to be a problem, has driven up prices and slowed production.

A trusted parts supplier is more important today than ever. A company you can rely on to do the work for you and provide solutions to your needs so your projects can continue and be completed. With over four decades in business as a passive electronic components distributor, Beckmann Elektronik’s experience is vast. Whether you’re looking for a hard-to-find item or the latest product from quality brand manufacturers for their designs, you can count on us to go the extra mile to secure it for you. And in the unlikely event that we can’t find it for you, our staff can find suitable alternatives.

Proactive action will be required and a break with the motto “Just in Time. “This pandemic will require a new way of thinking, since things will not continue as before afterwards. The power issue between China and the USA, for example, will directly affect Europe.

Together, we can secure the supply chain through careful consideration and strategic foresight.